In the world of real estate investment, House of Multiple Occupation (HMO) properties have emerged as an intriguing and potentially lucrative avenue for investors. HMO mortgages offer unique opportunities, providing higher rental yields and diversification compared to traditional buy to let properties.

In this article, we will delve into the world of HMO mortgages, exploring their benefits, challenges, and considerations for prospective landlords.

Understanding HMO Mortgages

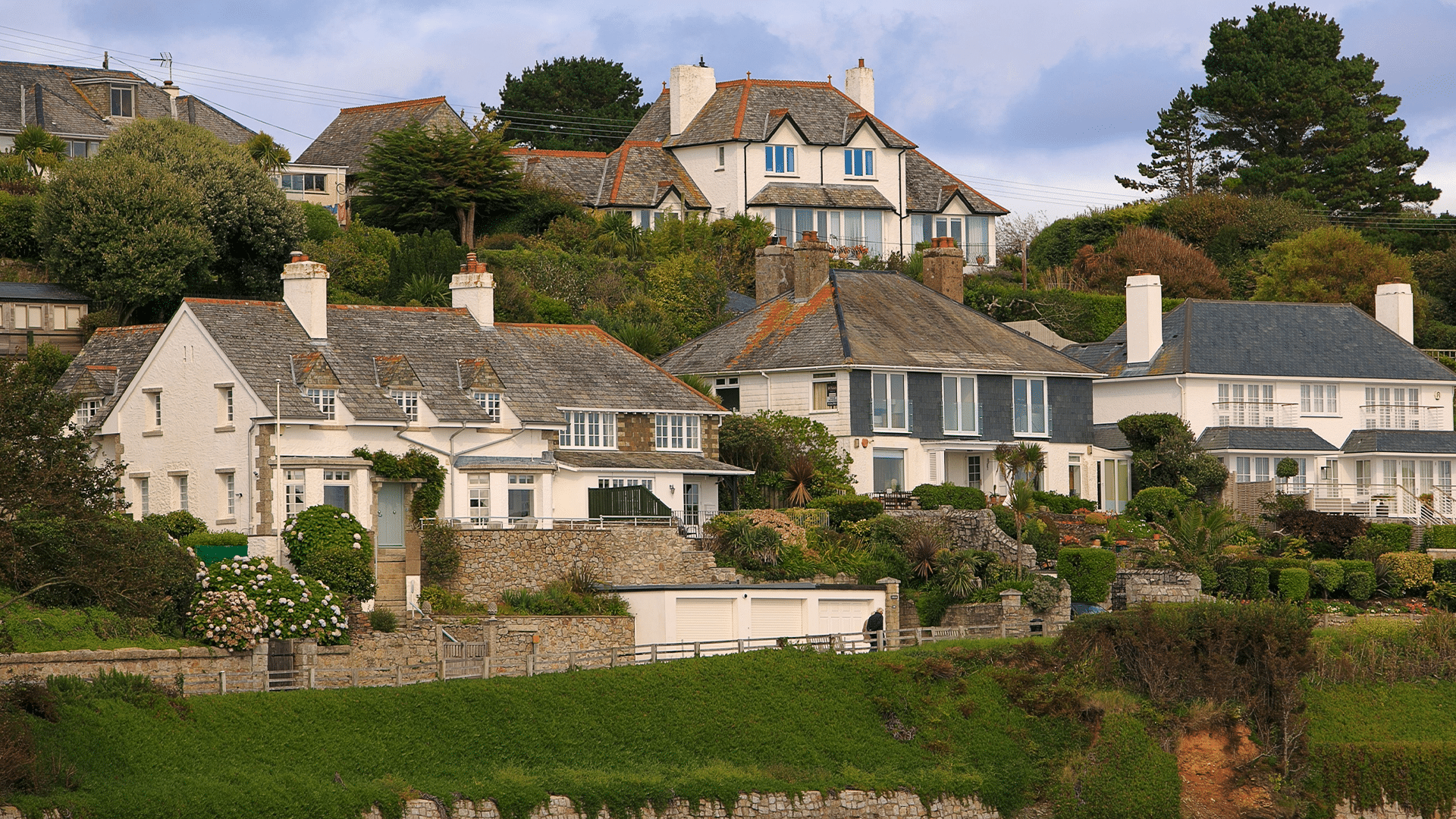

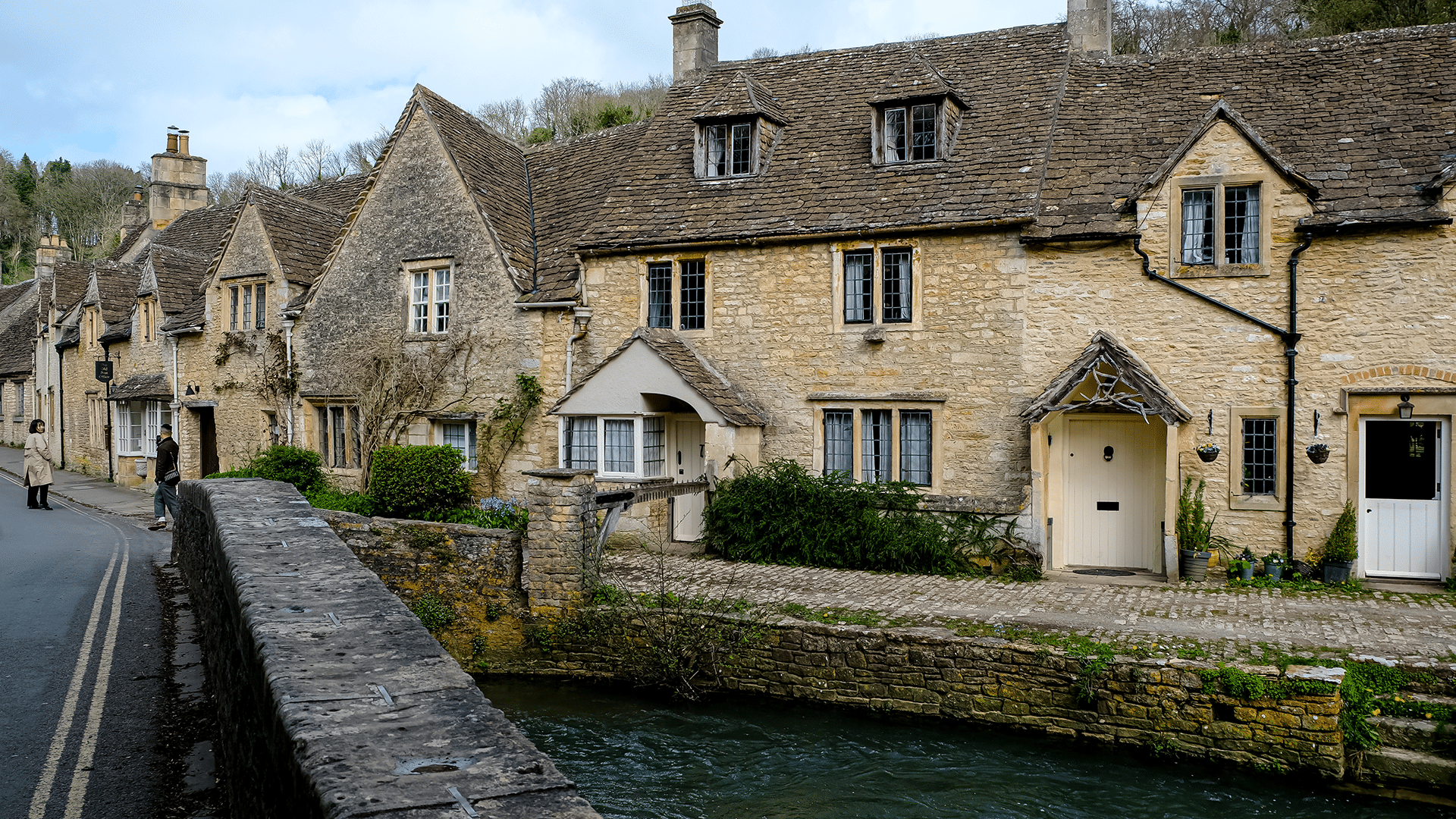

HMO, short for House of Multiple Occupation, refers to properties that contain multiple letting rooms.

These properties encompass a variety of buildings, ranging from spacious townhouses to purpose-built structures with individual lockable rooms. HMO properties are subject to distinct local authority regulations and fire safety standards, which set them apart from conventional buy to let properties.

The Experience Factor

For those considering HMO ownership, prior experience as a landlord is often a valuable asset. Lenders tend to favour individuals who have previously managed standard buy to let mortgages in Newcastle. This preference stems from the recognition that overseeing HMO properties requires a deeper understanding of regulations, tenant dynamics, and property maintenance due to their complex nature.

Pros and Cons of HMO Mortgages

HMO mortgages present both advantages and drawbacks for investors. One of the primary benefits is the potential for higher revenue due to multiple tenants. Unlike conventional single-family rentals, an HMO property can generate income from several tenants residing in separate rooms. However, this unique arrangement also introduces challenges, such as managing diverse tenant needs and potentially higher management demands.

HMOs and Student Tenants

HMO properties often cater to student tenants due to their proximity to educational institutions. While these properties can offer lucrative returns, they also come with their share of challenges.

Student tenants are more likely to cause wear and tear on the property, and turnover rates can be higher. As a result, effective property maintenance and management are crucial to sustaining the property’s value and income potential.

Landlord Structures: Personal vs. Limited Company

Choosing the appropriate ownership structure is a pivotal decision for HMO investors. Two common options are personal ownership and ownership through a limited company, often referred to as a Special Purpose Vehicle (SPV).

The decision depends on individual tax considerations and circumstances. While both options have their positives, seeking personalised advice in Newcastle is essential to determine the optimal approach for each investor.

Navigating HMO Tenancy Agreements

Tenancy agreements within HMO properties can take different forms. Some landlords opt for separate agreements for each tenant, while others prefer a unified agreement with multiple signatures. The choice often depends on the lender’s preferences.

Multiple agreements offer flexibility in tenant replacements, while a single agreement with multiple co-signatures provides enhanced security. A mortgage advisor’s expertise can help align the landlord’s plans with the lender’s requirements.

Speak With a HMO/Buy to Let Expert

HMO mortgages represent a unique and potentially lucrative venture in the real estate market. HMO ownership offers enhanced rental yields and the opportunity to diversify investment portfolios.

Whether the HMO will be used for students, young professionals, or other demographics, if you’re thinking of investing in an HMO mortgage, seeking buy to let mortgage advice in Newcastle is crucial. Our team of dedicated mortgage advisors in Newcastle specialise in HMO mortgages and buy to let investments.

Date Last Edited: August 16, 2023